How Much Is Fashion Industry in Us

Fashion is constantly evolving.

Seasons modify. Tastes transform. Fads come and go.

Ruled by subjectivity, take a chance weaves itself into the fashion industry … blessing one moment. Cursing the next.

And it'southward not but a matter of style.

How way ecommerce brands operate is constantly evolving besides. New technologies, shifting markets (at both geographic and economic levels), plus the shadow of profitability.

For ecommerce, COVID-19 thrust a decade of growth into a single year. It'southward also overturned traditional loyalties and given birth to a new wave of direct-to-consumer winners.

Threading the needle calls for a clear understanding of the ten trends shaping ecommerce way.

i. Ecommerce Style Industry Grows to $1 Trillion by 2025

The business of fashion is more than big; it'southward the biggest of the large.

With a global marketplace value of $759.5 billion in 2021, apparel, accessories, and footwear are the number 1 ecommerce sector in the world.

Over the next five years, online fashion's vii.eighteen% compounded annual growth rate will put the industry at +$1.0 trillion.

Fueling this growth are ii factors: penetration rates — as divers by "the share of active paying customers" — and ecommerce's share of retail fashion.

Estimates project an overall increase in ecommerce penetration from 46.six% this yr to 60.32% past 2024. Applied to the three major fashion segments:

- Apparel: +12.vii%

- Footwear: +11.half dozen%

- Numberless & Accessories: +viii.5%

Though more minor, that represents a total market share lift from 21.03% in 2020 to 23.66% in 2023.

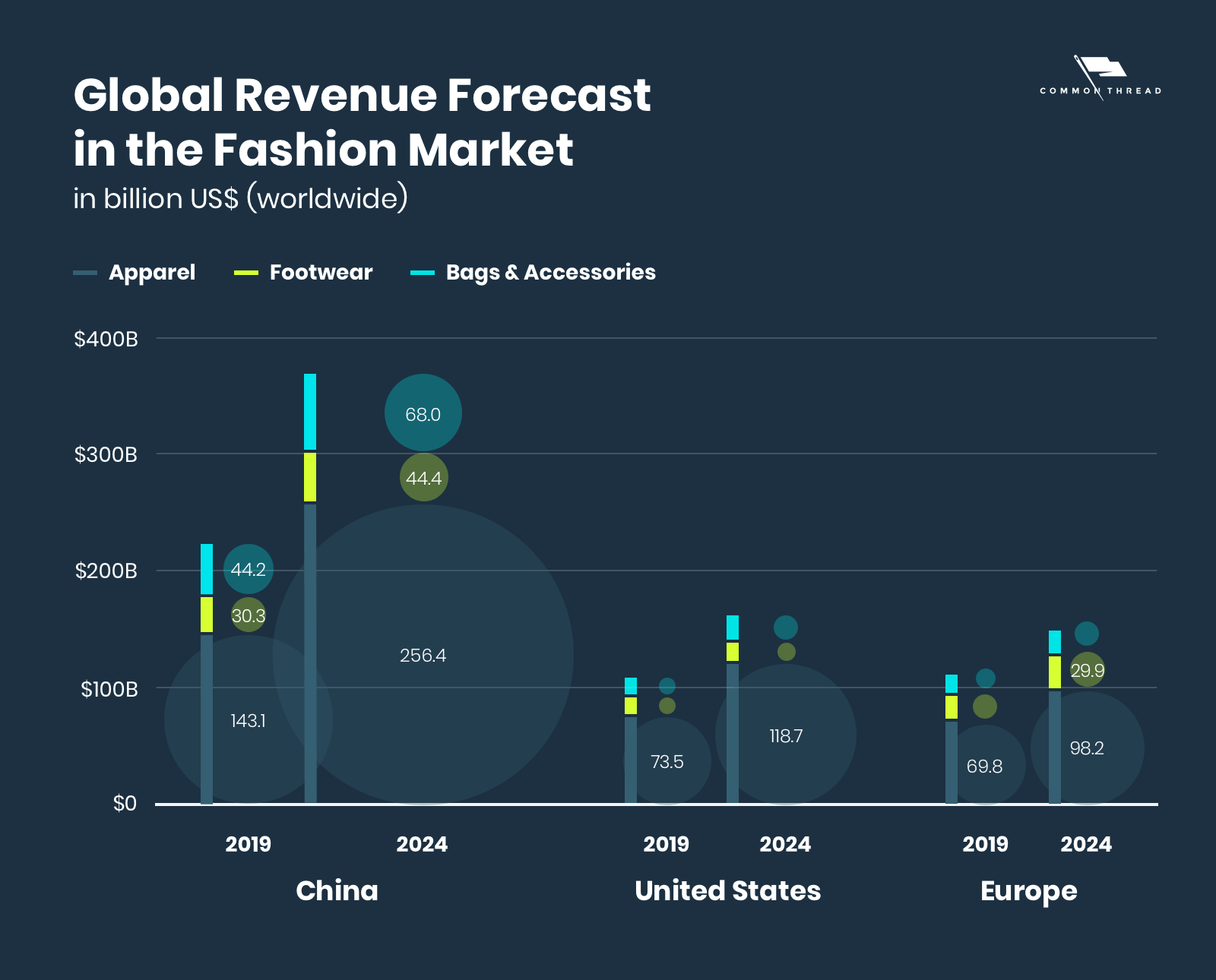

2. Global Expansion Continues East, But ARPU Rules the West

Geographically, consumption tilts heavily toward Mainland china; its $284.3B in 2020 sales outpacing the next four countries combined:

- Prc: $284.3B

- United States: $126.5B

- United Kingdom: $32.5B

- Japan: $23.9B

- Federal republic of germany: $22.5B

Moving forward, China's dominance will merely intensify …

International data should not exist used to downplay North America and Europe's role in shaping worldwide preferences. Nor the opportunities still emerging domestically.

Globally, coronavirus hit online apparel and accessories hard. Conversely, eMarketer reports nine% YoY growth in the U.s. and a step-alter in its pct of full retail sales from 26% to 37%.

In add-on, individual United states consumers already out spend their Chinese and European counterparts as evidenced past average acquirement per user (ARPU).

That gap is expected to widen substantially:

iii. Vertical Growth: Accessories, Apparel, Shoes, Luxury & Eyewear

Of course, amass data tin can be a catchy matter. Especially during a global pandemic.

Against eMarketer's +9% YoY change, Statista shows slight declines in 2020 versus 2019. Vertical-past-vertical examinations in the U.s.a. reveal marked disparities, with luxury products and accessories (i.e., watches, jewelry, baggage, and bags) bearing the burden of losses …

- Accessories: -12.69%

- Luxury: -eleven.11%

- Footwear: -5.54%

- Eyewear: -4.nine%

- Apparel: -ii.88%

The practiced news is that compounded annual growth rates over the next five years are up and to the right for mode at big likewise as every subcategory.

In other words, no matter what source y'all plough to the prognosis is the same: either 2020 will end with online fashion in the black or its losses will rebound in 2021.

With projections to benchmark your own growth, one final piece of foundational data must exist attended to before looking at examples of these ecommerce trends in action.

4. Divides Deepen Between Fast Fashion and Designer Brands

Call it H.Due east.N.R.Y. (loftier earners not rich yet) versus C.A.R.50.Y. (tin can't beget real life yet), "Generation C" versus "Generation Due north," new-luxury versus dollar-shoppers … or simply brands versus commodities.

Regardless of the name, the divide between haves and have nots has never been more than stark. Or, rather, between those willing to pay for appearances (H.Eastward.Due north.R.Y.) and those who don't have the luxury (C.A.R.L.Y.).

Economic gaps are likewise bifurcating commerce. Contempo history is littered with mid-market mishaps — both online and off. In the US, income and wealth gaps accept both deepened over the final decades:

Shopping habits reflect these divides; particularly retail behemoths aimed at cost-conscious consumers as well every bit their fast-fashion equivalents.

Regardless of the generation, superstores, discount stores, and warehouse clubs have become de facto choices. Section stores and local boutiques, in last identify.

The same is true online; well-nigh notably, Amazon and enterprise online business organization' lion share of the market place.

No industry bears this mark more than clearly than style.

And no sub-category should be more alert to its effects than DTC.

Equally middle-form consumers either disappear, seek experiences (over things), or achieve upward beyond their means … brands must as well make a choice.

Up-market place. Down-marketplace. Or languish in-between.

From make to merchandising, advertising to advancement, even pricing to loyalty, the implications of this selection affect every other trend.

Perhaps nowhere is it more relevant than the next.

5. Profitability & Sustainability Storm the 2021 Fashion Track (Finally)

The struggle of profitability isn't new. Even earlier coronavirus, its casualties were mounting.

DTC darlings like Outdoor Voices, Everlane, Abroad, and Bonobos accept all found themselves below headlines with one theme: at scale, the economics of ecommerce don't piece of work.

At the aforementioned time, outliers accept emerged.

Among the 435 companies listed in 2PM, Inc.'s DNVB Power Listing, 170 belong to the apparel or accessories category. The next largest: health and wellness with 94.

The Superlative 20 Apparel or Accessories Digitally Native Vertical Brands

- StitchFix

- Barstool

- GOAT Grouping

- MeatEater

- Happy Socks

- Blenders

- Prive Reveaux

- Bow & Curtain

- Bucketfeet

- Eloquii Inc.

- Mahabis

- GREATS

- Brava home

- Bonobos

- Qalo

- ModCloth Inc.

- FANCHEST

- Fashion Nova

- Allbirds

- Depop

Though not ranked in the top xx, Gymshark is perhaps the most instructive. After selling 21% to Full general Atlantic in Aug at a +£1 billion valuation, contempo news majored on its unicorn status.

Typically cited strengths include a healthy mix of paid and organic social media, influencer marketing, and IRL events … all anchored in unifying its community.

Less lauded in the mainstream was the brand's negative greenbacks conversion wheel. Gymshark's financial filings revealed not just operating profits at +£18 million and cash reserves of +£thirty 1000000 merely likewise shrewd payment terms with suppliers.

— Jay Vasantharajah (@jayvasdigital) July 16, 2020Cash conversion cycle (CCC) is a measure of how many days it takes for a biz to plough invested cash (ordinarily purchased inventory) back into greenbacks in its banking concern account.

The formula is: Days Inventory + Days AR - Days AP

Gymshark'southward CCC is -101 days.$AMZN = -21 days$WMT = 2 days

"A negative cash conversion bicycle means that their vendors are financing their operations. As their sales grow, their cash residuum magically increases instantly."

Gymshark's surface-level tactics certainly played a major role. And aye, we'll examine a number of those trends as manifested in other fashion brands below.

Still, the company'due south financial savvy fueled rapid growth without demanding the rock-and-difficult-place selection many cash-strapped DTC brands face: long-term debt or pre-mature VC investment.

Vasantharajah's article (linked above) provides a handful of steps to negotiate terms. The point, however, isn't necessarily to go forth and replicate.

Instead, it's a call to reorient fashion from frontend flare to backend books.

An interlude on assisting growth …

Despite complexity, profitable growth comes down to four metrics: visitors, conversion rate, LTV (your cash multiplier), and variable costs.

Without hyperbole, that unmarried equation is the hereafter of ecommerce; fashion or otherwise.

As an agency, it's fundamentally shifted how we structure client relationships. It's also come up to life in two resources. One, a guide on the ecommerce business concern strategies derived from the equation.

And two, this tutorial detailing its development and implementation:

As brands movement from market place share to dollars in their pockets, knowing your variables and taking agree of those with the highest likelihood of impact will ascertain success.

vi. Personalization 'Coutures' the Online Store Experience

Given fashion's focus on self-expression, information technology makes sense that modern mode consumers actively seek personalized experiences.

This goes well beyond the typical personalization techniques that have go status quo by today's standards. Things similar including the customer's name in your emails or delivering product recommendations based on their purchase history are table stakes.

Hyper-personalization digs into the client's behaviors, preferences, and purchase history to make up one's mind how best to deliver value to them moving forward.

The exemplar of this trend is Stitch Fix. Since its inception in 2016, the DTC startup has grown in value to roughly $2.9 billion every bit of June 2020.

Through the use of artificial intelligence and machine learning, Stitch Set determines the verbal products to evangelize to its individual customers on a subscription basis.

That level of personalization may experience out of reach. Thankfully, the principles behind it are anything just.

For starters, quiz funnels have get a staple of new client acquisition for Common Thread Collective'south way clients besides every bit our in-firm brands.

Tools like Octane AI or Typeform (if you lot actually need to be scrappy) make frontend cosmos easy. They also make backend integration smooth with email marketing platforms like Klaviyo. With each, straight admission to your product catalogue and client information (e.m., Shopify, Magento, or WooCommerce) must be accessible.

Onsite tools such every bit Nosto take hyper-personalization a step further, delivering dynamic onsite content to users based on their appointment history. This goes for product recommendations, folio re-create, and more than.

7. Multi-Aqueduct Demands Immersion through Social Media

With the above in listen, it should be no surprise that multi-channel marketing has become a necessity. Terms like multi-channel and omni-channel often experience cloaked in complexity. Peculiarly for growing retailers.

Put simply, multi-aqueduct ecommerce ways establishing a consistent and purchase-centered experience on the digital spaces consumers inhabit. It demand not span the internet.

Nor does it need being everywhere for everyone.

Instead, savvy brands expand one channel at a time: mastering and prioritizing their presence along 4 frontiers …

As a guide, consider Fabletics.

Recently, the brand launched a straightforward sales entrada with Kevin Hart. Information technology began with a serial of ads run natively through Kevin'south Instagram, led to a custom landing page (rather than the homepage, production page, or collection page), and culminated in a six-part quiz:

Simultaneously, Fabletics released paid and organic content through its own social-media accounts, too featuring Kevin as well every bit competitive messaging:

The entrada'due south crowning celebrity appeared on what is frequently considered the least "cutting-edge" channel: an email from Fabletics sent through Kevin Hart'south name:

For all its seeming complexity, the approach essentially runs on three channels: Facebook, onsite (through a custom landing folio and quiz), and email.

But because they interlock with a consistent message, those channels immerse their audience.

Lifestyle accessory brand, Dorsal, does something like: anchoring its spend on Facebook and Snapchat, then extending into halo efforts on …

- Branded Google Ads to capture demand

- Worldwide advertising to extend its accomplish, and

- Email besides as SMS depending on traffic source

In addition to enhancing the customer experience for their electric current audition, this allows manner businesses to aggrandize intentionally.

Whether targeting new audiences, experimenting with new social-media platforms, or testing new creatives – multi-channel marketing is a key to growth in the fashion industry.

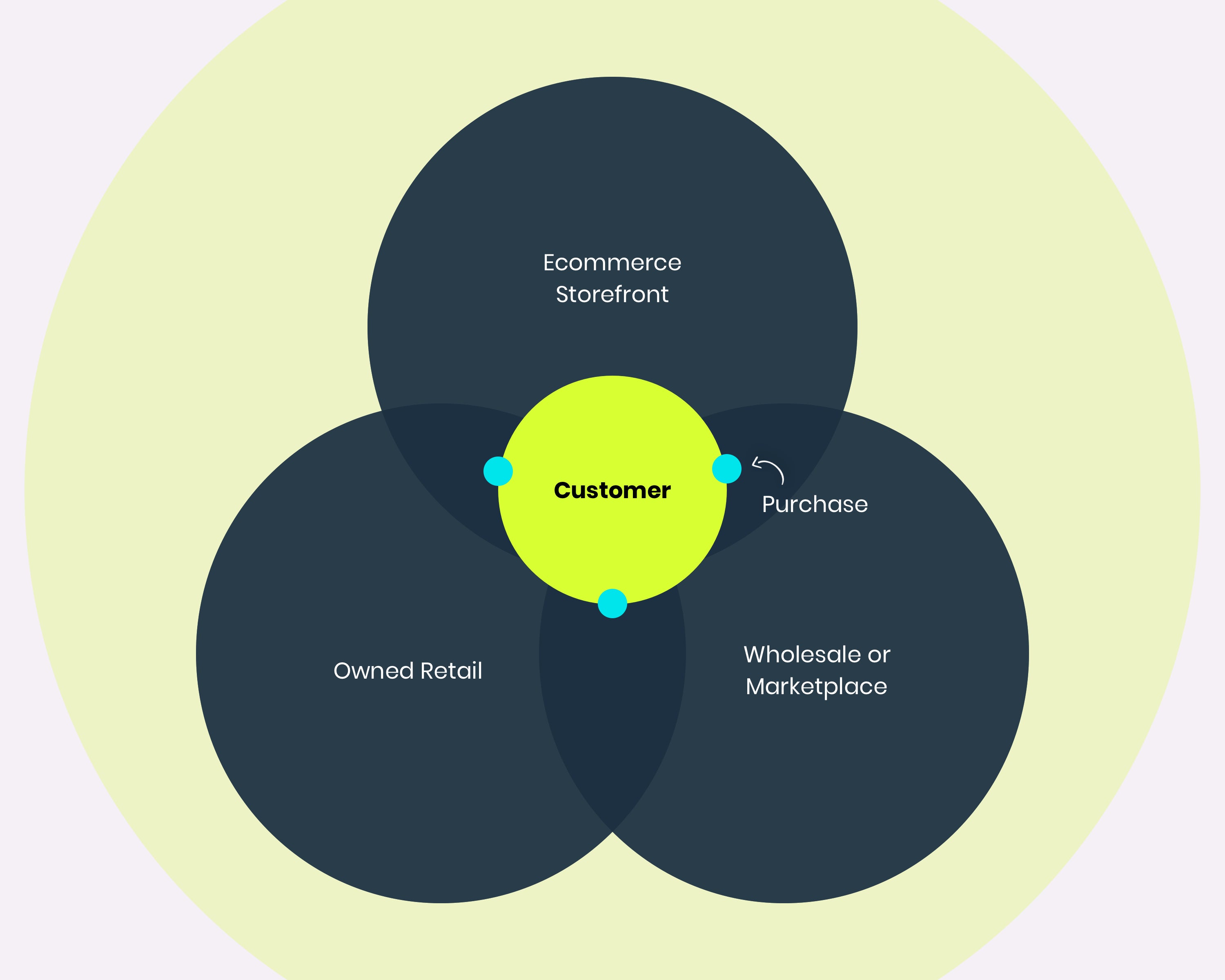

8. Retail Mode Remains, Beckoning Omni-Channel Operations

Where multi-channel connects digital experiences, omni-aqueduct bridges the online-to-offline divide through a "single view" of customers (i.e., data) with three points-of-purchase:

- Ecommerce website

- Owned retail location(south)

- Wholesale partnerships or marketplaces

Numerous born-online way labels accept already proven the value of maturing into endemic retail. Primary amid them, names like Lululemon, Happy Socks, UNtuckit, and Rhone.

Shoe make APL (Athletic Propulsion Labs) inverted that traditional path by starting its journeying in luxury retailers, expanding into online DTC iii years agone, and so establishing its flagship shop in late 2019.

Even amongst COVID-19, DNVB juggernaut Pura Vida Bracelets made its groundbreaking proclamation.

Why? Because in addition to creating a cohesive customer journey, omni-aqueduct operations allow mode brands to create tactile customer experience.

As Nate Checketts, Rhone's co-founder and CEO, explains: "While transactions continue to calibration and tilt towards seamless digital environments, the impetus for transactions are influenced past IRL offline."

For Rhone, equally with most clothes, that "impetus" includes (ane) what customers currently own and honey, (2) what friends or family own and talk about, and (3) in-person, in-store interactions.

9. Fashionable Predictions: Social, Loyalty & Intimacy + Returns

What study on ecommerce style trends would be consummate without predictions?

Rather than peer into the future through hazy buzzwords, instead let's hone in on three issues and three predictions … from three leaders at the forefront.

Problem: Online Shoppers Aren't Ownership Native Social Commerce

Despite characteristic releases, PR, and new integrations, native commerce — i.due east., ownership inside social-media platforms like Facebook and Instagram — has had a tough go of it.

At best, consumers are nonetheless getting used to the idea of making purchases directly through social media. At worst, it's a losing battle that won't exist won for at least another generation.

Prediction: Social Media Becomes Mode's Landing Page to 'Just Let Me Purchase'

Marco Marandiz , Ecommerce DTC Strategist

"I see a big transition from the website being the primary channel for how you generate transactions. Moving forwards, we'll see a lot more drops as a business model, a bigger part of the revenue mix for direct-to-consumer businesses.

"Websites volition become less relevant and social media channels — TikTok, Instagram, Twitter, YouTube — those are going to be far more powerful for driving sales direct to a specifically built site to make a sale. At that place won't be the whole lifestyle photography and product descriptions and all of that stuff.

"At that place'll exist a shift towards using social media channels equally your landing page and very elementary transactional experiences for commerce. Maybe that'southward non 'DTC 3.0,' but it'southward the next iteration because most people are deciding to buy things when they encounter the advert, when they see the influencer, when they come across the content, that's when they make the decision to purchase.

"If someone'due south already bought-in on an influencer, already bought in that this celebrity is going to sell me this hoodie, then just allow me buy it."

Problem: Loyal Customers Are a Rare Commodity in the Manner Industry

Co-ordinate to a July 2020 survey from Qubit, 37% of consumers shop with more than brands than they did a twelvemonth ago — and 46% are less loyal to brands than they used to be. What's more, fully 75% of Americans have changed brands during the pandemic.

At the same fourth dimension, seventy.6% of fashion consumers say they brand purchases on company websites instead of third-party sellers.

Consumers don't mind beingness loyal — they just need to accept good reasons.

Prediction: Retentivity Data past Cohort Volition Feed Greenbacks Flow & Centre on 'Happiness'

Jeremy Cai, CEO & Founder of Italic

"Primarily relevant for brands looking to scale: y'all need to exist realistic in looking at your business from an objective and quantitative lens.

"Invest in reporting early on on and develop competency effectually understanding and dialing in the metrics that matter for your business on a cohort basis. The sooner you do this, the better equipped yous'll be to respond how to grow your business organization. Don't put this off.

"Let's say you sell your hero product for $100 and your contribution margin is $l, and let's say you were acquiring early on customers at $30 on Facebook, that'south great, double down. Just once your CAC has grown to $60, it'll be besides late to course-correct.

"What you accept to know is how much those customers who bought your hero production — and whatever other leading products — are worth to you month subsequently calendar month. Not over a lifetime, only inside timetables that feed your cash flow.

"Economies of scale are purely theoretical in DTC and you demand to invest in condign a information-driven organization early on. The radical part of Italic's model is that we get to prioritize our members' happiness by making retention our driving metric."

Problem: Online Shopping Lacks Intimacy, Especially for Support & Returns

As ecommerce adoption escalates and first-time shoppers plow online, a chief danger is losing intimacy. Retail can forge relational experiences, but customer support is often the but option for online brands. Particularly, firsthand back up — before, during, and later a purchase.

Ascension return rates are another danger that loom big over online fashion:

Prediction: Tiny Keyboards Can Accost Both Problems in Real-Time

Vanessa Skaggs, Marketing Manager at Pura Vida Bracelets:

"SMS and mobile messaging volition overtake all channels every bit the master source for people to reach out. Future generations will find ways to take mobile shopping, mobile checkouts, mobile payments to another level through Messenger platforms, texts, live conversation, and chatbots."

"Take a highly aesthetic and digitally native Gen Z movement like VSCO girls. When a VSCO girl laughs information technology's 'SKSKSK.' It doesn't audio similar laughter. But if you look at your phone keyboard, where are S and K buttons located? Immediately underneath your thumbs. So, 'SKSKSK' has replaced 'LOL' or 'Hahaha' — even though H and A are mayhap one or two keys more inside."

"With social trends influencing ownership trends, more and more people will want direct interaction immediately on the places they alive — their phones. Hardwired mobile users whose expectations of online shopping won't be limited to fashion ecommerce stores, ecommerce sites, or online shops.

"They'll also want to accept care of returns and exchanges through those mobile devices. The beautiful affair is the more active you lot become on those tiny screens, the more proactive you get every bit someone shops, returns not simply get faster simply fewer."

10. Coronavirus, Style's Hereafter and Why Everything Naught Has Inverse

The COVID-19 shutdown did major damage to the fashion industry, causing what some take called an existential crunch. "No-i wants to buy apparel to sit at dwelling in," said Simon Wolfson, CEO of Next.

Admittedly, this statement could exist overblown. The activewear sector experienced a spike in sales during shutdown — an increase caused past the need for comfortable clothes to work and workout in from home.

The betoken of Wolfson's statement is that well-nigh people aren't buying article of clothing or way accessories to look good. Since they tin can't become out and show off their new duds, many consumers are avoiding fashion-related purchases birthday.

With a surplus of now-out-of-style products, fashion companies are left wondering what to practice.

Some take tried offloading old stock via clearance sales and promotional offers. Others have decided to hold and rebrand information technology for next year. Still, others have looked to expand into different geographic markets where old stock may exist more in demand.

Breakout success, all the same, has come from brands tailoring their arroyo to the needs of their customs.

None illustrate this level of authenticity better than fitness apparel brand, Born Primitive. Like all fashion labels, coronavirus hitting Born Archaic hard. March 16th was the single worst day in company history. Within that claiming, still, lay a massive opportunity.

Turned off by standard "work out at dwelling" campaigns, Bear Handlon — Born Archaic's CEO — organized a 50%-profit-sharing initiative with gyms across the US.

For creative, Comport and Born Primitive'south athletes shot explainer videos, posted them organically, and quickly scaled spend:

With "Back the Gyms" every bit its COVID-xix cornerstone, Born Archaic and CTC transformed March 16th's all-fourth dimension low into an all-fourth dimension high with …

- +201% YoY growth in 2020

- 16.31 ROAS during the campaign

- And +$180k in donations to local gyms

Community-centric initiatives amidst COVID-19 also led to an unlock for wedding and active accessory make, QALO.

Inspired past healthcare workers within the medical community, QALO responded with the Strata "Pulse" Silicone Band.

Added to the product was a giveback plan; for each purchase of the rings, $ten was donated to Project N95 to help source personal protective equipment to those in need.

Launched at the end of April 2020, the rings rapidly sold out in popular colorways. Every bit a result, more than than $125k has been donated.

The growth and engagement resulting from the First Responder ring entrada serves equally a potent reminder that the core of success comes from supporting your unique client communities.

And then, has coronavirus inverse everything?

No. But only because both examples coalesce effectually a single theme mutual to all the information and trends we've examined …

The More than Manner Changes, the More Manner Stays the Same

In the end, the state of ecommerce way is good. Evolving? Yep. Risky? Certain. Without challenges? Of class not.

Nonetheless, every source declares: "From biggest to even bigger."

Common to each trend is the centrality of customers. Seasons alter. Tastes transform. Fads come and go.

Only people stay people.

Regardless of style … nosotros all want to belong. We all want buying to exist easy. And we all want to look good.

If you want assist growing your way make along those same lines,and then beginning a conversation with us today.

Or, if you want to see us prove it first, download both the Way Industry Report and our Ecommerce Style Marketing Guide — the 2nd is packed with tactics and real results from Common Thread Commonage clients.

Oft Asked Questions (FAQ)

Is fashion the biggest manufacture?

Online, yes. With a global market value of $759.5 billion in 2021, apparel, accessories, and footwear are the number one ecommerce sector in the globe. Past 2025, it'due south projected to abound to +$1.002 trillion.

What is the future of the manner industry?

Ten trends shape the futurity of style, especially the ecommerce way industry. The most influential include global expansion, fast fashion'south deepening divide from luxury, social-media influence, and omni-aqueduct uniting retail with online shopping.

How profitable is the ecommerce fashion industry?

In short, information technology depends on the business concern itself. Profits stem from agreement the ecommerce growth equation — (V x CR x LTV) - VC = $ — and running your own numbers through a framework like unit of measurement economics to summate costs and margins on a per-unit basis.

Aaron is the VP of Marketing at CTC. Previously the Editor in Chief of Shopify Plus, his content has appeared on Forbes, Mashable, Entrepreneur, Business Insider, The New York Times, and more. Connect with Aaron on Twitter or LinkedIn (specially if you want to talk almost bunnies or #LetsGetRejected).

0 Response to "How Much Is Fashion Industry in Us"

Post a Comment